tax saving tips for high income earners uk

This is a huge tax break for most and really ups the gain. In the last few weeks HMRC has been sending out tax coding notices for 202223 which apply from 6 April 2022.

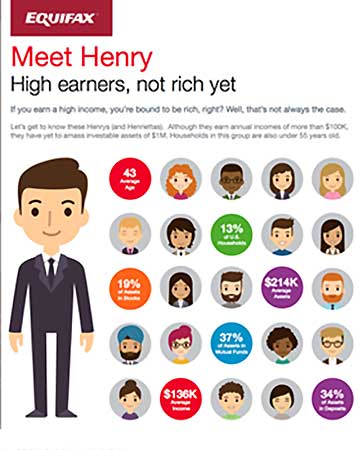

Meet Henry High Earners Infographic Equifax

If your incomes below this threshold you dont need.

. With rates as high as 37 for high-income earners. There are currently three rates - the standard 20 increased from 175 on 4 January 2011. After income tax National Insurance and 5 per cent pension contributions the recommended minimum this is reduced to 23111.

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Under this amount the saving you make with Childcare Vouchers exceeds the saving you can make with Tax-Free Childcare. Higher-rate taxpayer parents with total childcare costs of 6252 or less.

With student loans in the rearview high-income earners will have the most financial options. You dont pay tax on the first 7500 you make each year from renting out a room halved if you share the income with a partnersomeone else. Long-term capital gains tax rates are 0 15 20 or 28 with rates applied according to income and.

Higher earners as anyone earning 100000 or in a couple where one earns 100000 isnt eligible for the scheme whereas these high earners can. These days its not unusual to have a property worth that amount meaning middle income earners could. The average UK mortgage payment is 669 per month or 8028 per year.

UK oil and gas windfall tax sorry energy profits levy Its a 25 percentage pt incr in existing tax rate on the sector from 40 to 65 with relief for increased investment. However this does not factor in housing costs. Different rates of VAT apply to different goods and services.

BudgetingSaving Banking Credit Cards. But the lack of a student loan payment is a welcome change to any budget. The threshold for paying inheritance tax is 325000 - which hasnt increased since 2009.

Receiving your new tax code. On the face of it this is about 50 per cent more than average retirement income.

Free Childcare In Scotland How To Guide Childcare Childcare Costs Early Learning

Tax Minimisation Strategies For High Income Earners

How To Save On Income Taxes Using An Ingenius Trust

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

How To Pay Less Taxes For High Income Earners Wealth Safe

Lower Income Americans Are Still Waiting For The Benefits Of The Biden Boom Forbes Advisor

How Do High Income Earners Reduce Taxes Australia Ictsd Org

7 Roth Ira Advantages In Saving For Retirement Inside Your Ira Many Americans See A Roth Ira As A G Roth Ira Saving For Retirement Investing For Retirement

Retirement Options For High Income Earners Canaccord Genuity

Pin On Best Of The Millennial Budget

How To Pay Less Taxes For High Income Earners Wealth Safe

Not All Taxes On The Rich Are Created Equal Tax Policy Center

Calculating Child Support For High Income Earners Child Support Laws Calcula Child Support Laws Child Support Payments Child Support Quotes Child Support

Are You A Henry High Earners Not Rich Yet Financial Samurai

Advanced Tax And Business Planning For High Income Earners Wealthy Individuals Neil Jesani Cfp Youtube

Tax Planning Strategies For High Income Earners The Private Office